[This article was also published in Global Nerdy.]

Technology, media and pop culture writer Douglas Rushkoff, who’s got a guest writing slot at the uber-blog Boing Boing, points to an essay titled Riding Out the Credit Collapse. Published in the spring 2008 edition of Arthur magazine, it:

- Provides a layperson-friendly, non-drowsy explanation of how the credit crisis came about

- Suggests the single most important thing you can do to protect yourself and your interests during the credit crisis (and in fact, any crisis, including being laid off during a credit crisis)

Don’t let the article’s apparent length scare you off — read it! Yes, it’s ten screens, but it’s set in a narrow column. If you’re still skittish about reading that much, shame on you, and here’s the part on which I want to focus:

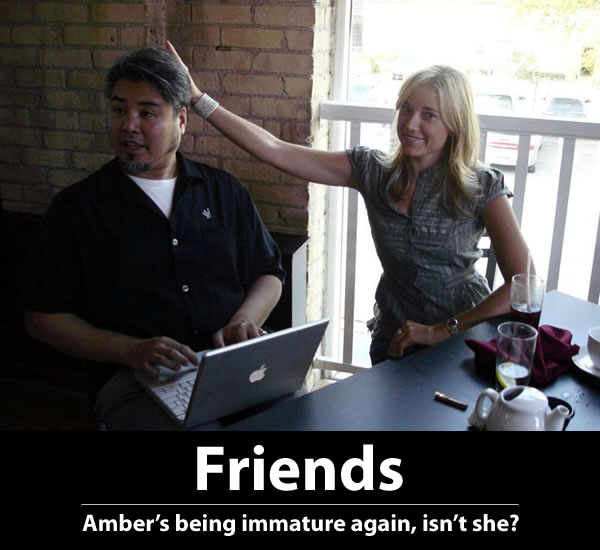

Whatever the case, the best thing you can do to protect yourself and your interests is to make friends. The more we are willing to do for each other on our own terms and for compensation that doesn’t necessarily involve the until-recently-almighty dollar, the less vulnerable we are to the movements of markets that, quite frankly, have nothing to do with us.

If you’re sourcing your garlic from your neighbor over the hill instead of the Big Ag conglomerate over the ocean, then shifts in the exchange rate won’t matter much. If you’re using a local currency to pay your mechanic to adjust your brakes, or your chiropractor to adjust your back, then a global liquidity crisis won’t affect your ability to pay for either. If you move to a place because you’re looking for smart people instead of a smart real estate investment, you’re less likely to be suckered by high costs of a “hot” city or neighborhood, and more likely to find the kinds of people willing to serve as a social network, if for no other reason than they’re less busy servicing their mortgages.

I think Rushkoff’s got the right idea, and I’d like to torque it a little further. Forget for a moment the more fanciful ideas of printing your own “Canadian Tire Money”; when he says “local currency”, I want you think of these things:

- Reputation,

- Goodwill,

- and most importantly, Luck.

Among the many things that I’m churning in my brain right now — along with updating the resume, finding a place to put all the stuff that I used to keep at the office and getting that eye appointment with Dr. Heeney before my work-provided insurance coverage expires — is real-world testing an idea and writing about it here. That idea rests on two principles, namely:

- Having friends and being friendly makes you lucky. I’ve always suspected it, and Marc Myers wrote a book on the topic.

- I’d rather be lucky than smart. It’s the mantra of my all-time favourite financial planner, whom I shall refer to as “P. Kizzy”. If I get even a tenth of P. Kizzy’s business acumen, I will be a very happy man.

Watch this space, ’cause I’m going to expand on those ideas!

4 replies on “Terminated, Part 2: How I’ll Ride Out the Layoff and the Credit Crunch: Friends”

Hey, we have the same optometrist! Dr. Heeney is very nice.

And by the way, my condolences on your sudden freedom. Or congratulations?

I want to read it, but I’m at work right now, I don’t think I should take the risk. I’ll read it later at home.

According Guy,

Fun site. Thanks so much for mentioning my book. You have luck exactly right!

Marc Myers

Author

How to Make Luck: 7 Secrets Lucky People Use to Succeed

Sounds like the beginning of your own ‘Joy Luck Club’ Joey! I like the idea. And your direction.

Kudos to you and all your hard work!!