I thought I’d show another explanation of what’s being referred to as the “Subprime Meltdown”, “Subprime Mortgage Crisis” or “Credit Crunch”, this time using comics.

(I linked to the New York Times’ recent explanation in this entry.)

If you’re still wondering what the connection between people with no business carrying a mortgage and the collapse of Bear Stearns is, you might find the illustrations below useful. I’ve assembled them from two sources: a black-and-white stick figure slide presentation that Anne Onimos pointed me to and a six-panel colour comic sent to me by my friend Miss Fipi Lele. Enjoy!

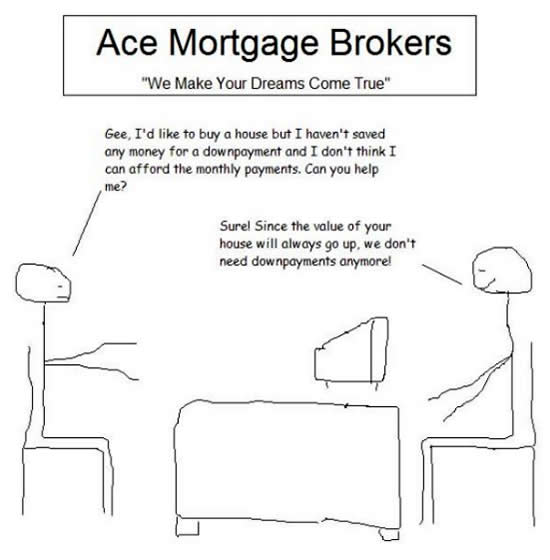

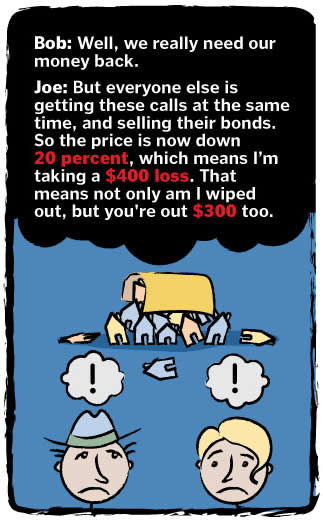

At the Mortgage Broker’s…

High-Risk Customer: Gee, I’d like to buy a house, but I haven’t saved any money for a down payment and I don’t think I can afford the monthly payments. Can you help me?

Mortgage Broker: Sure! Since the value of your house will always go up, we don’t need down payments anymore!

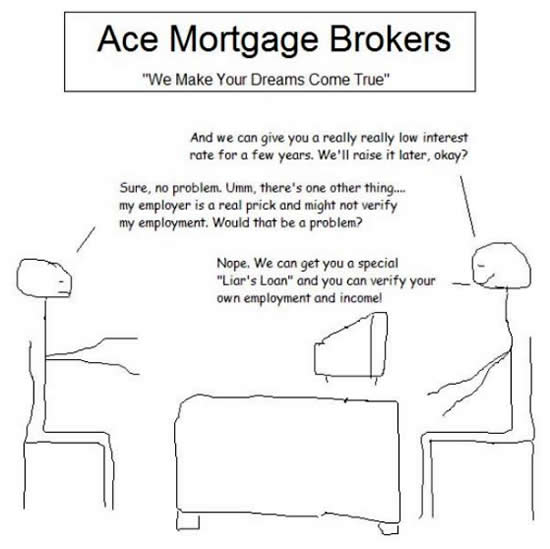

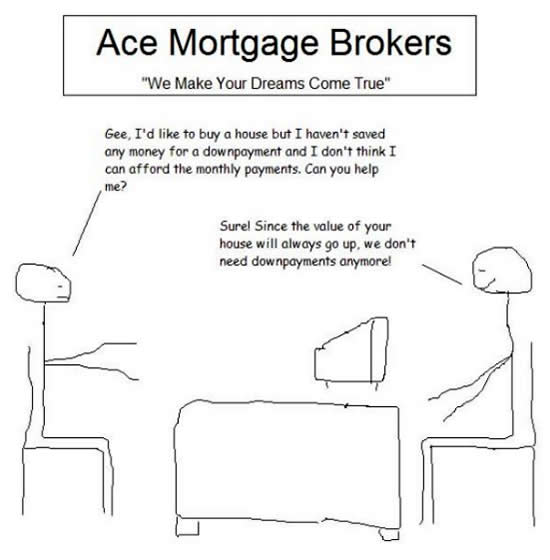

Mortgage Broker: And we can give you a really, really low interest rate for a few years. We’ll raise it later, okay?

High-Risk Customer: Sure. Ummm…there’s one other thing — my employer is a real prick and might not verify my employment. Would that be a problem?

Mortgage Broker: Nope — we can get you a special “Liar’s Loan” and you can verify your own employment and income!

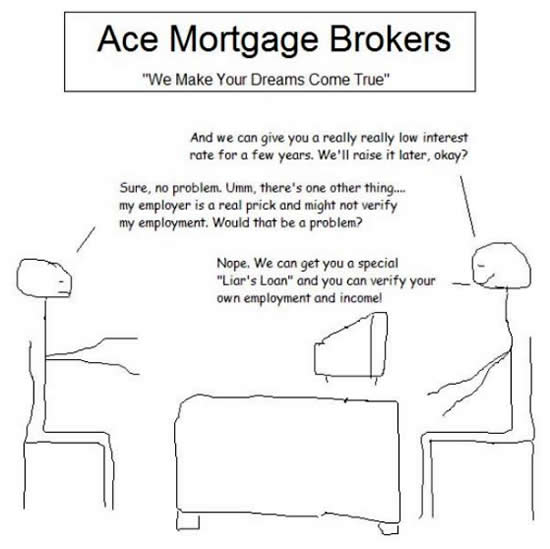

High-Risk Customer: You guys are awesome! You’re really willing to work with guys like me.

Mortgage Broker: Well, we don’t actually lend you the money. A bank will do that. So we don’t really care if you repay the loan. We still get our commission.

High-Risk Customer: Wow! Let’s get started!

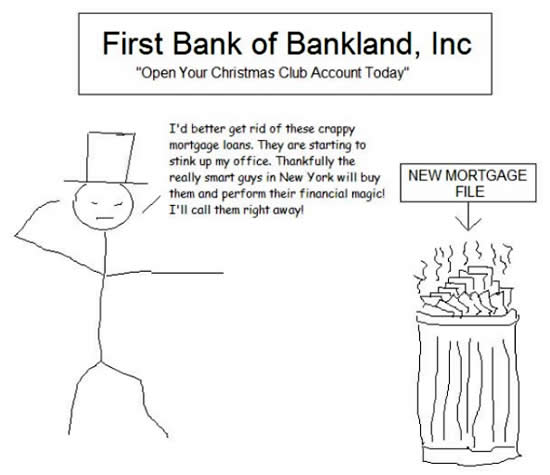

A Few Weeks Later, at the Bank…

Banker: I’d better get rid of these crappy mortgage loans. They’re starting to stink up my office. Thankfully, the really smart guys in New York will buy them and perform their financial magic! I’ll call them right away!

Let’s See What the Smart Guys are Doing…

Investment Banker Boss: Phew! We’d better get rid of these shitty mortgages before they start attracting flies.

Investment Banker Underling: But who would buy this crap, boss?

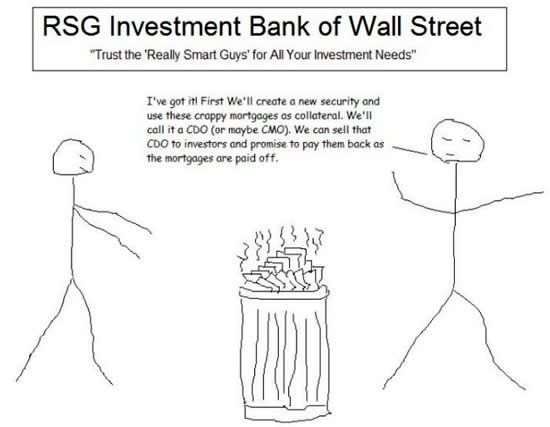

Investment Banker Boss: I’ve got it! First we’ll create a new security and use these crappy mortgages as collateral. We’ll call it a CDO (or maybe a CMO). We can sell that CDO to investors and promise to pay them back as soon as the mortgages are paid off.

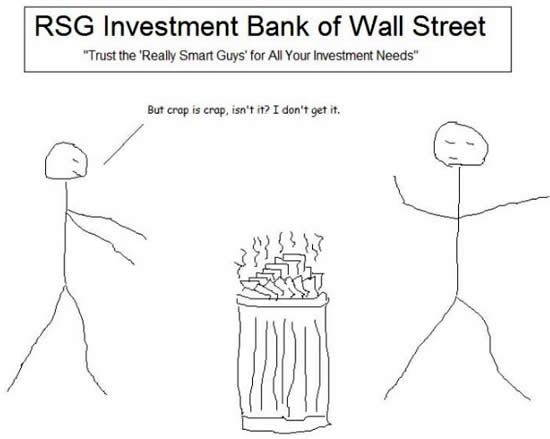

Investment Banker Underling: But crap is crap, isn’t it, boss? I don’t get it.

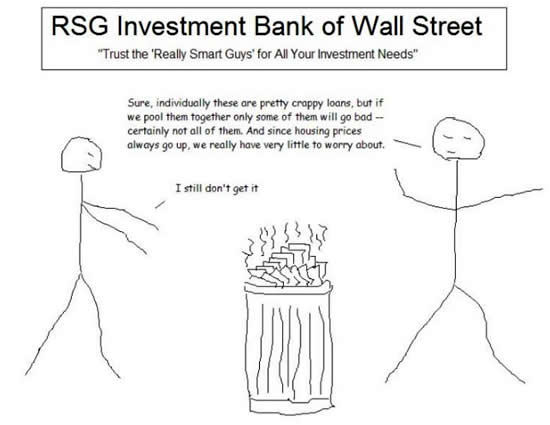

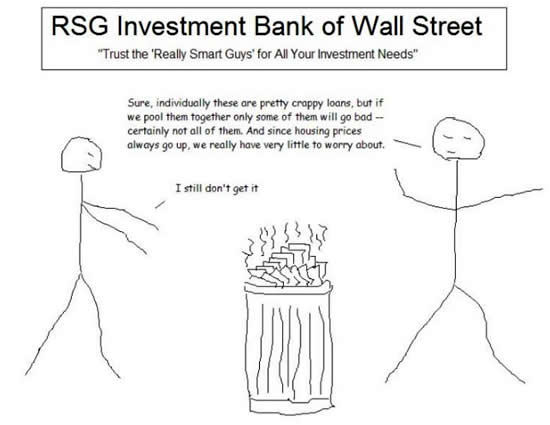

Investment Banker Boss: Sure! Individually, these are pretty crappy loans, but if we pool them together, only some of them will go bad — certainly not all of them. And since housing prices always go up, we really have very little to worry about.

Investment Banker Underling: I still don’t get it.

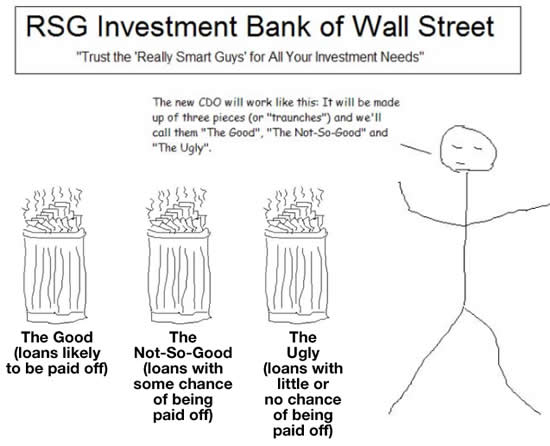

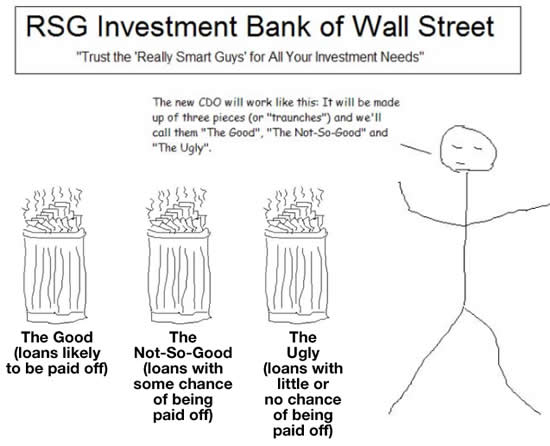

Investment Banker Boss: The new CDO will work like this: it’ll be made up of three slices or tranches and we’ll call them:

- The Good

- The Not-So-Good

- The Ugly

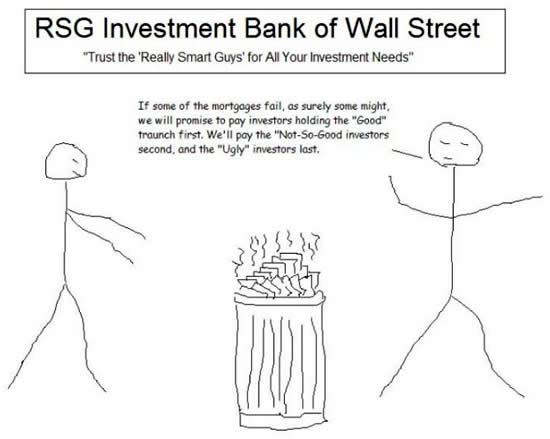

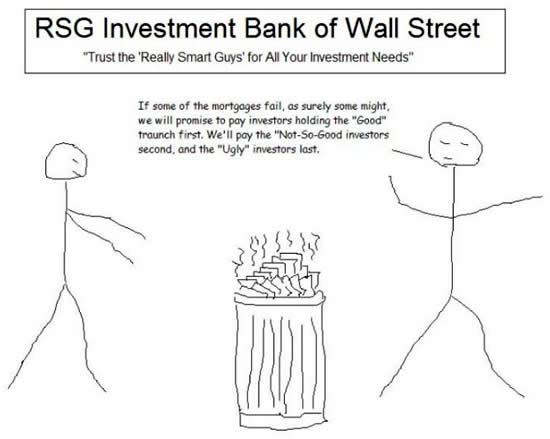

Investment Banker Boss: If some of the mortgages fail, as surely some might, we’ll promise to pay investors holding the “Good” tranche first. We’ll pay the “Not-So-Good” investors second, and the “Ugly” investors last.

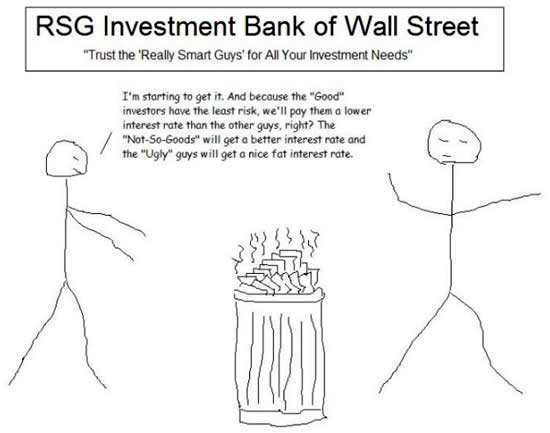

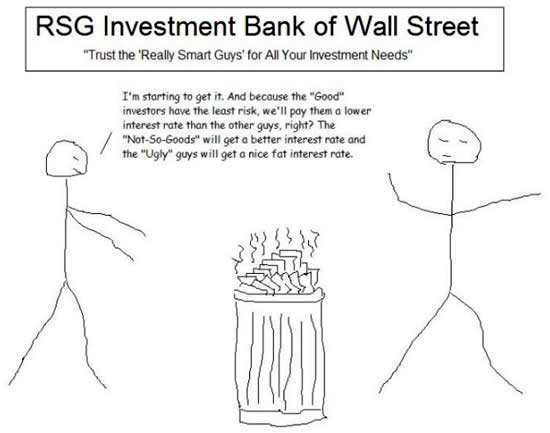

Investment Banker Underling: I’m starting to get it. And because the “Good” investors have the least risk, we’ll pay them a lower interest rate than the other guys, right? The “Not-So-Goods” will get a better interest rate and the “Ugly” guys will get a nice fat interest rate.

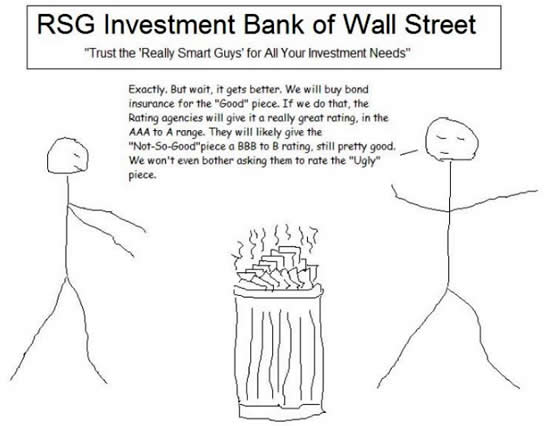

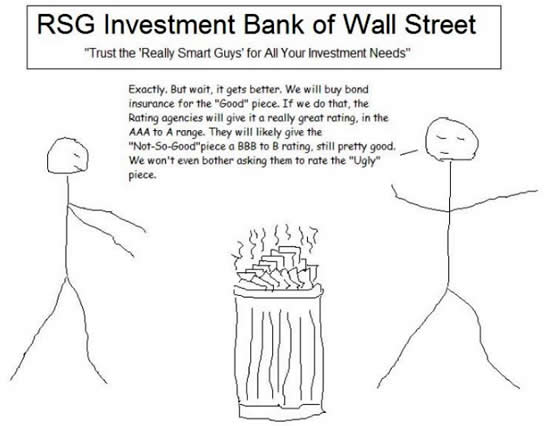

Investment Banker Boss: Exactly. But wait — it gets better. We’ll buy bond insurance for the “Good” tranche. If we do that, the rating agencies will give it a really good rating, in the AAA to A range. They’ll likely give the “Not-So-Good” tranche a BBB to B rating. We won’t even bother asking them to rate the “Ugly” tranche.

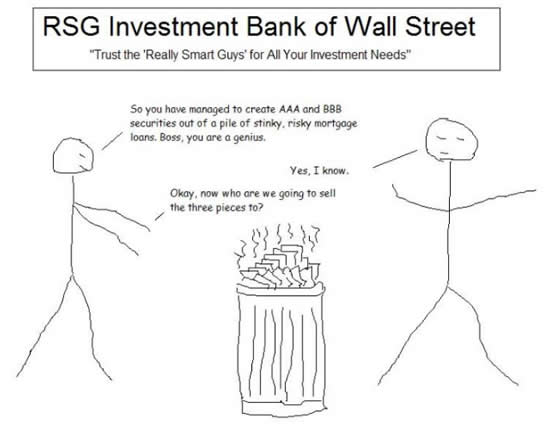

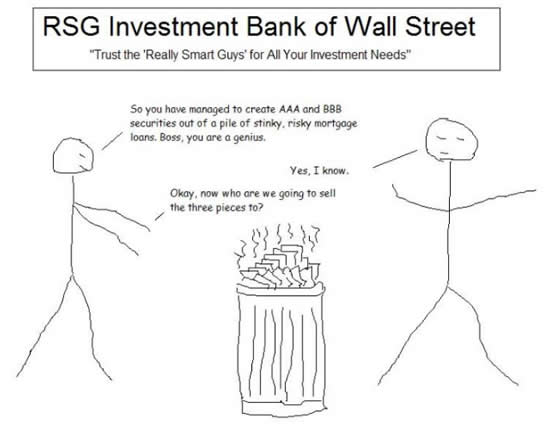

Investment Banker Underling: So you’ve managed to create AAA and BBB securities out of a pile of stinky, risky mortgage loans. Boss, you’re a genius!

Investment Banker Boss: Yes, I know.

Investment Banker Underling: Okay, now who are we going to sell the three tranches to?

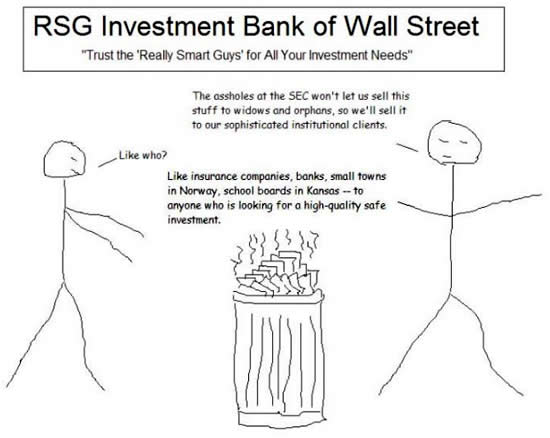

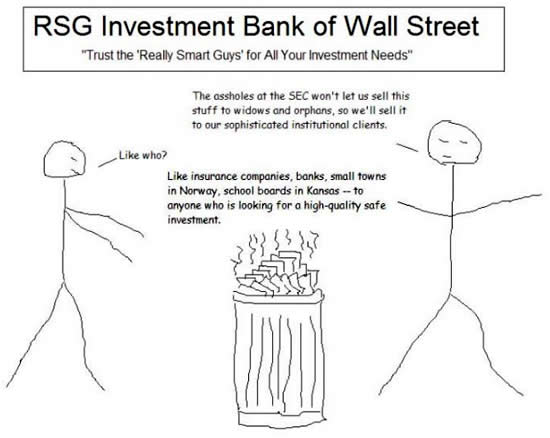

Investment Banker Boss: The assholes at the SEC won’t let us sell this stuff to widows and orphans, so we’ll sell them to our sophisticated institutional clients.

Investment Banker Underling: Like who?

Investment Banker Boss: Like insurance companies, banks, small towns in Norway, school boards in Kansas — anyone looking for a high-quality, safe investment.

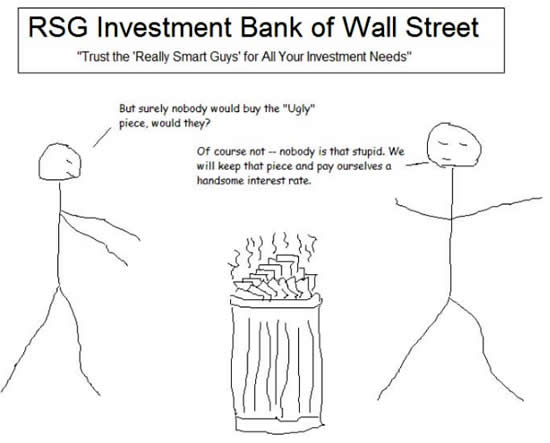

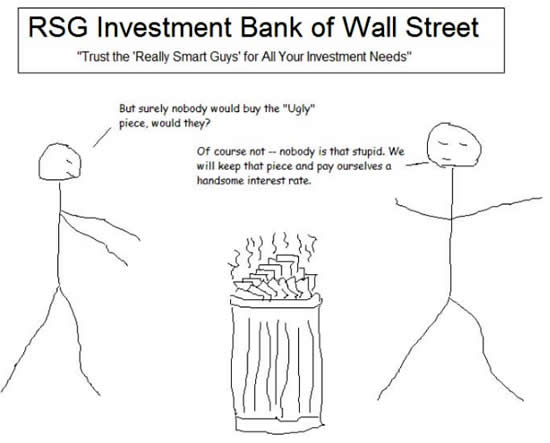

Investment Banker Underling: But surely nobody would buy the “Ugly” tranche, would they?

Investment Banker Boss: Of course not — nobody’s that stupid! We’ll keep that piece and pay ourselves a handsome interest rate.

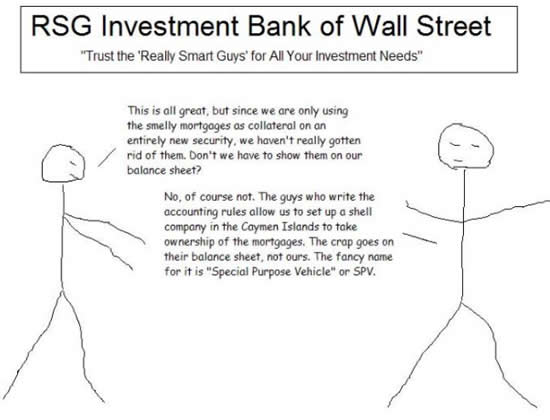

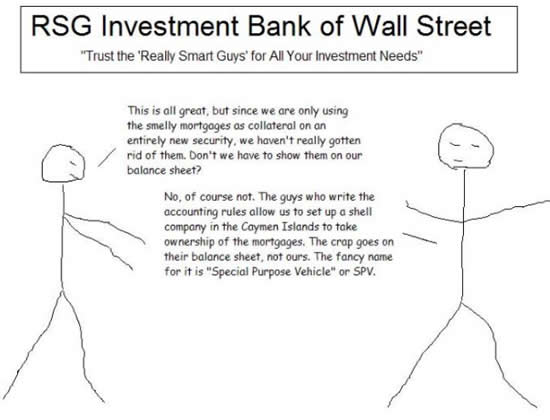

Investment Banker Underling: This is all great, but since we’re only using the smelly mortgages as collateral on an entirely new security, we haven’t really gotten rid of them. Don’t we have to show them on our balance sheet?

Investment Banker Boss: No, of course not! The guys who write the accounting rules allow us to set up a shell company in the Cayman Islands to take ownership of the mortgages. The crap goes on their balance sheet, not ours. The fancy name for this is “Special Purpose Vehicle”, or SPV.

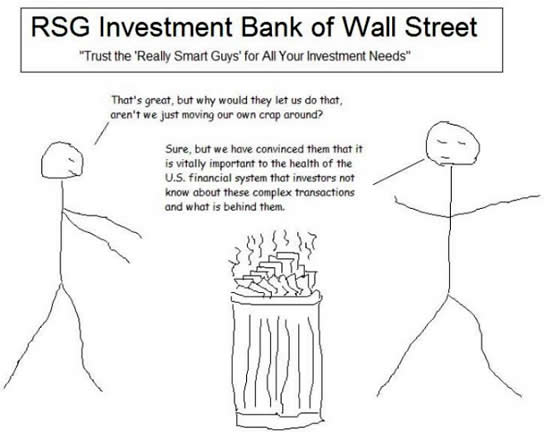

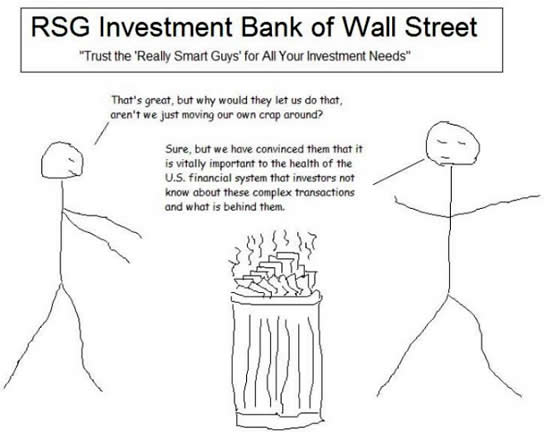

Investment Banker Underling: That’s great, but why would they let us do that? Aren’t we just moving our own crap around?

Investment Banker Boss: Sure, but we’ve convinced them that it’s vitally important to the health of the U.S. financial system that investors not know about these complex transactions and what’s behind them.

It Seemed Like a Good Idea at the Time…

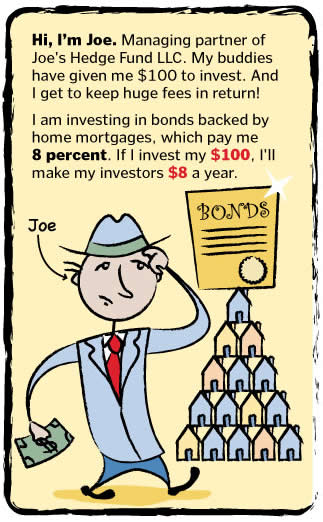

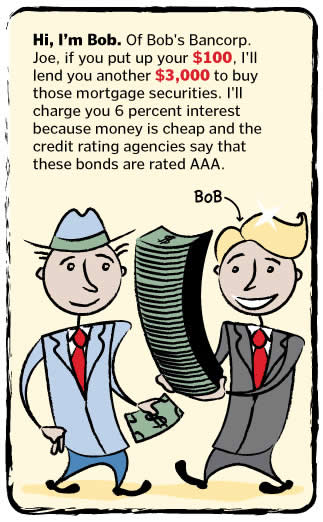

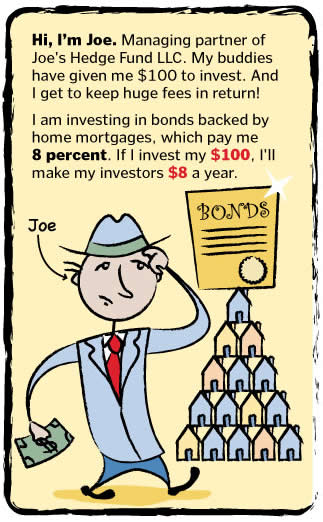

Hi, I’m Joe. Managing partner of Joe’s Hedge Fund LLC. My buddies have given me $100 to invest. And I get to keep huge fees in return!

I am investing in bonds backed by mortgages, which pay me 8 percent. If I invest my $100, I’ll make my investors $8 a year.

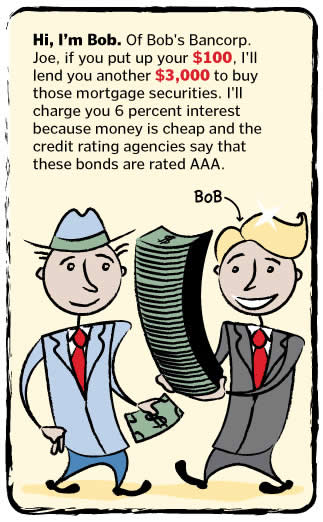

Hi, I’m Bob. Of Bob’s Bancorp. Joe, if you put up your $100, I’ll lend you another $3,000 to buy those mortgage securities. I’ll charge you 6 percent interest because money is cheap and the credit rating agencies say these bonds are rated AAA.

Joe: This means I can invest $3,100 in these mortgage bonds. At 8 percent, that will pay me $248. Even after I pay your $180 in interest, I still have $68 left. Which means I have earned a 68 percent return on the original $100 I invested. Even after I take out my fees, my investors will be very happy.

Bob: And my shareholders are happy to see us getting this business.

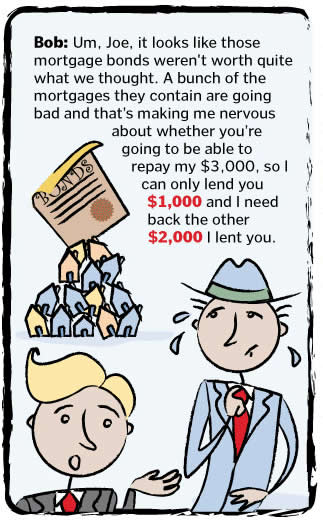

…Then 2008 Rolls Around…

Bob: Um, Joe, it looks like those mortgage bonds weren’t worth quite what we thought. A bunch of the mortgages they contain are going bad and that’s making me nervous about whether you’re going to be able to pay my $3,000, so I can only lend you $1,000 and I need back the other $2,000 I lent you.

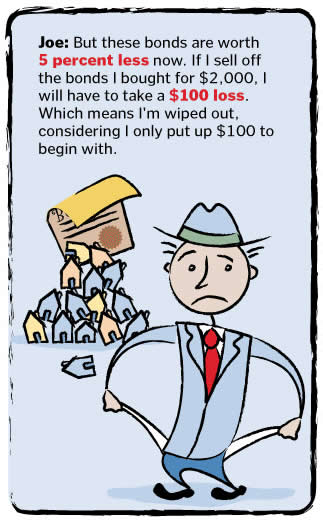

Joe: But these bonds are worth 5 percent less now. If I sell off the bonds I bought for $2,000, I will have to take a $100 loss. Which means I’m wiped out, considering I only put up $100 to begin with.

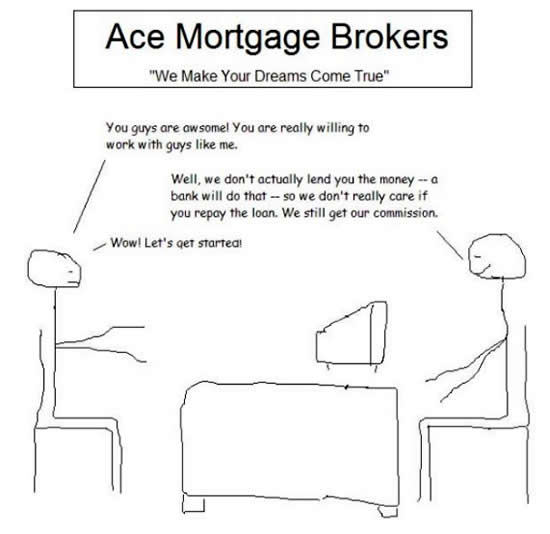

Bob: Well, we really need our money back.

Joe: But everyone else is getting these calls at the same time, and selling their bonds. So the price is now down 20 percent, which means I’m taking a $400 loss. That means not only am I wiped out, but you’re out $300 too.