I found this one via Ian Bremmer, who writes: “Making the rounds in the Kingdom presently.”

Want to see the other ones?

I found this one via Ian Bremmer, who writes: “Making the rounds in the Kingdom presently.”

Want to see the other ones?

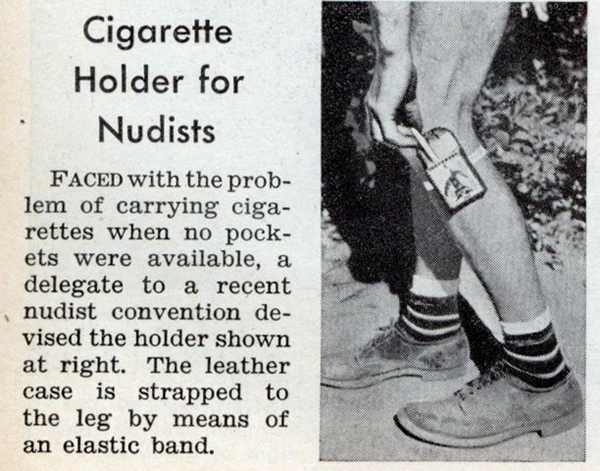

Not a bad idea, since the one we have built-in is a pain in the ass to use.

Tomorrow is Tax Day in the United States: the deadline for U.S. taxpayers to file their tax returns for the previous tax year, or failing that, file for an extension. Normally, Tax Day falls on April 15th. However, since:

…Tax Day falls on April 17th this year. For similar reasons in 2017, when April 15 fell on a Saturday, Tax Day was April 18th.

If you’re in Canada, you probably know that you have a couple of extra weeks to file: Tax Day there is April 30th.

Tax Day wasn’t always April 15th. When Form 1040 first made its appearance in 1914, Tax Day fell on March 1st. It was moved to March 15th a few years later, and then to April 15th in the 1950s.

I can’t post a piece about tax day and taxes without pointing you to last night’s feature story on Last Week Tonight, which was on corporate taxes, and how corporations dodge them.

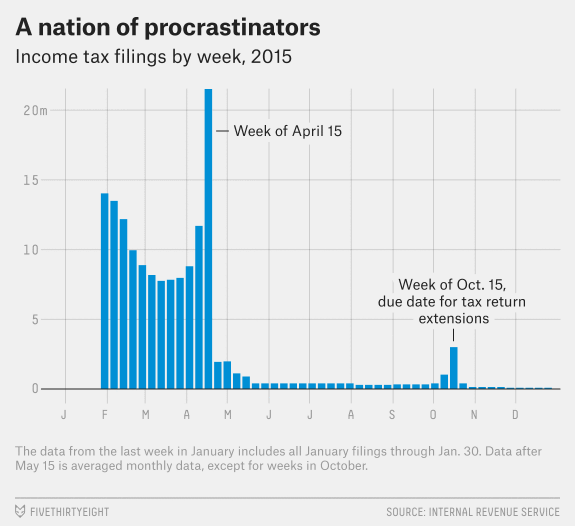

Of the approximately 150 million Americans who have to file taxes, about 20 million — more than one in seven — wait until the week before to do so. Yes, it’s no fun, but remember that three-quarters of people who file taxes get a refund (and remember, a tax refund is simply you giving the government an interest-free loan).

It depends, but none of it is fun. In the case of Wesley Snipes, who avoided paying $7 million in taxes between 1999 and 2001 (he made $40 million between 1999 and 2004) and then used a number of questionable legal tactics to defend said avoidance, it landed him a three-year prison sentence.

The best way to improve a story about bad decisions is to set it in Florida, and Snipes didn’t disappoint. His tax trial and subsequent sentencing took place in Ocala, which is about 100 miles north of Tampa.

For those of us who don’t owe millions nor have access to advisors who specialize in committing tax fraud, the options still aren’t pleasant:

Simply put: if you owe but can’t pay, file anyway!

If you can’t get your return filed in time, you need Form 4868, which buys you an extra six months to complete and file your tax return. It’s not even half a page long, and asks for just a few things:

What you don’t have to provide is any reason why you’re asking for an extension. Most requests for an extension requests are granted — I get the feeling that unless you’re Wesley Snipes, your request will probably go through.

The two gentlemen pictured below say “no”. In any other situation where you are invoiced, the person or organization doing the invoicing does all the work in calculating it, and all you have to do is say whether the invoice is correct or incorrect. But with taxes, you’re getting invoiced and you have to do all the calculating. The IRS already knows your income and finances, and could easily crunch the numbers and send you a bill. This practice is called return-free filing, and both Presidents Reagan and Obama have spoken in support of it.

Return-free filing is already done in some European countries, and it’s as simple as this:

For many people, this could turn the process of filing taxes into a simple one that doesn’t require specialists or special software, and would take minutes.

But return-free filing would take away a lot of profits from Intuit (as in Turbotax) and H&R Block (the tax accountant shop), and their lobbyists have worked hard to ensure to block any motions to make it possible in the U.S.. Propublica have covered this over the years…

…and the TV series Adam Ruins Everything did a nice job summarizing the problem in this clip from the “Adam ruins the economy” episode:

Wesley Snipes is most certainly not the only rich person to complain about taxes — you can see Cardi B’s now-famous rant in the video above.

Charles Barkley also used to complain about paying taxes — until Bill Russell had a word with him. Here’s Sir Charles recounting the story on the podcast The Axe Files with David Axelrod:

Bill Russell called me one time… He says, “Charles Barkley.” I said, “Yes, sir, Mr. Russell.”

“You grew up in Alabama. Right?” I said, “Yes, sir.”

He says, “Did you go to public school?” I said, “Yes, sir.”

He says, “Did the cops ever come to your neighborhood?” I said, “Yes sir.”

He said, “Any of the houses ever on fire and the firemen come?” I said, “Yes, sir.”

He said, “I don’t want to see your black ass on TV complaining about your taxes anymore.” I says, “What do you mean?”

He says, “So now that you got money you don’t want to help other people out, but when you were poor, other people took care of you.” And I says, “You know what, Mr. Russell, you will never hear me complain about my taxes again.”

And it was a very interesting lesson for me, because I do think rich people should pay more taxes. I’m blessed to be one of them, and we should pay more in taxes. I learned my lesson. I never complain about taxes.

Click the photo to see it at full size.

I haven’t played Shadowrun in ages! The last time I played, you had to combine magic and technology to get things like wireless networking and many other goodies that we consider typical today.

My character, Miguel Busey, is named after Florida Man Mike Busey, Gary Busey’s nephew, and former proprietor of the infamous Sausage Castle.

For those of you who look down your noses at playing role-playing games, here’s the TEDx talk Why Dungeons & Dragons is Good for You (In Real Life):