The Tampa Bay Times story Attempt to cash $1 million check at a Tampa Amscot leads to woman’s arrest, authorities say has many of the elements of a “Florida” story, but the way they tell it is disjointed and a little confusing. I thought that it could benefit from a timeline and some context, and that’s what I’ve written below.

Take a seat, grab a beverage, and read on. This is the story told in chronological order, with additional background information that you may find helpful…

February 2019, St. Petersburg, Florida

A woman and man attend a benefit for the Florida Holocaust Museum held at the Vinoy Renaissance Hotel, a Marriott that should really be a JW Marriott, and one of the higher-end venues in St. Petersburg. They pose for the photo above, which appears in the Tampa Bay Times.

The woman is Lin Helena Halfon, an Israeli national, who is in the U.S. on a visa and is currently applying for a “green card”. The man is Richard Rappaport, president of a company in the medical supply distribution business.

Someday, in a made-for-streaming-TV dramatization of this story, the camera will freeze on this photo, and a voice-over will say “This picture tells you everything you need to know about their relationship.”

June 24, 2019: A clerk’s office somewhere in Hillsborough County, Florida

Halfon and Rappaport get a marriage license. In the state of Florida, this is not an actual marriage, but a license for the marriage to take place. It’s valid for 60 days from the date it’s issued.

When Anitra and I got our marriage license a month before our wedding, we were required to spend some time reading and certifying that we had read the Family Law Handbook before we could leave the county clerk’s office. It’s a serious book, whose seriousness is seriously undermined by its use of terrible Corel Draw clip art and the misuse of the Comic Sans typeface:

Tap the image to see it at full size.

As I wrote in my blog post from February 2015: “Believe it or not, this is an official government handbook on the topic of one of the biggest decisions you’ll make in your life, and it’s set in Comic Sans. Comic effing Sans.”

It’s also a downer of a read, as it seems to be mostly about what happens when your marriage doesn’t work out.

Here’s a snippet:

At this point, I should point out Halfon’s and Rappaport’s ages. She’s 26 years old, and he’s 77. He looks good for 77, but that doesn’t change the fact that he’s still nearly three times her age.

August 21, 2019: Sarasota, Florida

Photo from IHA Holiday Ads. Tap the photo to see the source.

The setting for the TV series The Golden Girls may have been Miami, but it feels like Sarasota. If you want your life to consist of nothing but shopping, golfing, and walking on the beach, and your idea of an exotic dish is tiramisu, you are going to love this place.

In this setting, Halfon and Rappaport marry in a civil ceremony at a county clerk’s office. No one in Rappaport’s family, not even his daughter Dayna Titus, are aware that the marriage is taking place.

Backgrounder #1: Amscot

Headquartered in Tampa and operating only in Florida, it seems as if every other strip mall has an Amscot branch. With their blue-and-yellow color scheme, they look like Blockbuster Video stores coming back from the dead, but they’re actually “providers of non-bank financial services”.

In other words, Amscot is yet another payday loan company that “services” the 8% of U.S. households who are unbanked. Like many other payday loan places, the lend money at usurious rates. If you check out the fine print at the bottom of the page describing their “cash advance” loans, you’ll see that the APRs range from 271.14% to 365.00%.

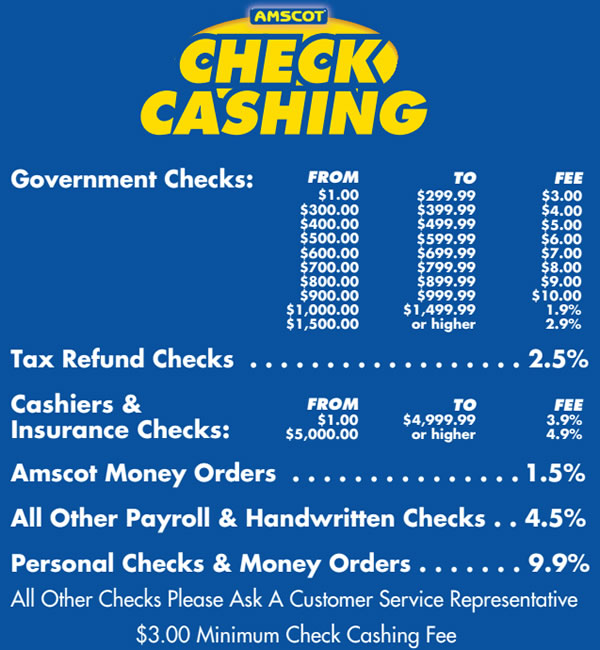

Another Amscot service is check cashing. The fee for this service varies with the type of check you want cashed:

If you’re unbanked and rely on Amscot to turn your paycheck into cash, you’re losing nearly 5% in the process. If you’re cashing a personal check, you’re taking a 10% bath.

The type of people who need to cash checks at this sort of place generally fall into one of two categories:

- People in less-than-ideal financial situations.

- People engaged in less-than-ideal business.

November 7, 2019: An Amscot branch in Tampa, Florida

An Amscot manager receives a phone call asking if they are able to cash a million-dollar cashier’s check. The caller says that his wife will arrive with such a check.

An hour later, Halfon visits the Amscot and asks them to cash the check. She tells the Amscot employees that she needs the cash so that she and her husband can buy a yacht, apparently unaware of how suspicious that sounds.

As a cashier’s check, it is guaranteed not to bounce by the issuing bank. However, it is made out to both Halfon and Rappaport. As a check made out to two people with the word “and”, both of them would have to be present in order to cash the check, and Halfon is alone.

The Amscot people tell Halfon that they can’t cash the check. The manager asks Halfon why she doesn’t do a wire transfer instead. Halfon says that she needed the money immediately, and that wiring the money would put a hold on the check. This is true — with a wire transfer, there’s a delay that can be as long as a couple of days.

Undeterred, Halfon doubles down and offered to pay $100,000 to have the check cashed. The Amscot staff still refuse. She leaves.

Halfon returns later that day with three new cashier’s checks, each for $333,333. Perhaps she thought that by breaking the $1 million into more “bite-sized” chunks, the sum wouldn’t seem so daunting and the Amscot people would give her the money.

The Amscot staff refuse to cash the checks. This time, they make copies of the checks and Halfon’s ID, which were her Israeli passport and U.S. visa. The Amscot staff ask her where her husband is, and she tells they that he is out of the country. After she leaves, they contact the authorities.

This brings up an interesting question…

Backgrounder #2: Is it even possible to cash a million-dollar check?

Even if you ignore how shady Halfon’s request was, her plan had a serious flaw. Remember, Amscot’s a payday loans place, and the typical payday loan is for a few hundred dollars. My guess is that any given Amscot branch would have something on the order of $10,000 in cash.

For comparison’s sake, consider banks. This article says that small banks might hold $50,000 or less, while larger banks might keep on the order of $200,000. The article also points out that the average take for a bank robbery in 2006 was $4,330, “which likely reflects how little money is kept up front with the tellers.”

Even the three “bite-sized” checks Halfon returned with would be too much for just about any bank to cash, never mind an Amscot.

November 8, 2019: The Rappaport residence

There’s nothing like an attempt to move a million dollars to get swift action. The day after Halfon’s two attempts to cash the checks at Amscot, investigators from the Florida Department of Law Enforcement (FDLE) interview Rappaport and his daughter Dayna Titus at Rappaport’s home.

The news reports don’t say how or why he would give Halfon a million-dollar cashier’s cheque made out to both him and her. Perhaps deep down, he suspected that he was being played for a fool, and this was his way of simultaneously showing his affections with a fabulous amount of money and not losing said money at the same time.

The reports are more clear on the fact that realized that giving her the check was a mistake. He asked her to return it, and according to an affidavit, she “berated Rappaport on the phone when he asked for the check back.”

November 12, 2019: Halfon’s apartment, Bayshore Boulevard, Tampa, Florida

After having interviewed Rappaport, the FDLE investigators interview Halfon.

For some reasons that have not yet been explained — but which you’ve probably already guessed — Halfon’s address is a Bayshore Boulevard condo that Rappaport owns, a completely different place from Rappaport’s residence.

For those of you not from Tampa, here’s a photo of Bayshore Boulevard, which should give you an idea of Halfon’s lifestyle:

Halfon tells the investigators that she and Rappaport had a fight about the checks. After the fight, she says she mailed the checks to her sister in Israel to keep them out of Rappaport’s hands. She says that Rappaport’s family had been pressuring him not to give her money, and that she would ask her sister to mail the checks back to her.

During the interview, the investigators make this gem of an observation, which appears in their affidavit: “Halfon further advised that she does not work, and Rappaport pays all her expenses, like a normal married couple.”

Twenty minutes after the interview

Twenty minutes after leaving Halfon’s apartment, the FDLE investigators get a call from Rappaport. He tells them that he believes that Halfon will return the checks, and that he didn’t want her “bothered or deported”.

My guess is that Halfon called Rappaport shortly after the investigators left, sounding appropriately distressed.

November 22, 2019: Check Pros, Carteret, New Jersey

A Florida man (of course) with an Orlando address successfully cashes one of the $333,333 checks that Halfon claims to have sent to her sister in Israel. He manages to do this at Check Pros, an Amscot-like provider of “non-bank financial services” in Carteret, New Jersey (their motto: “The center of it all”), which is 1,000 miles (1,600 km) north-northeast:

Remember: Halfon supposedly sent the checks to her sister in Israel. Here’s a map for the geographically challenged:

Tampa, Carteret, New Jersey, and Israel on a map. Tap to see at full size.

November 27, 2019: Check Pros, Carteret, New Jersey

The same Florida man successfully cashes another one of the $333,333 checks that’s supposed to be held for safe keeping in Israel.

Here’s a photo of the place — does it look like a place that would be able to cash a $333,333 check?

Check Pros looks sketchy, but check out Khalsa Sweet House’s Yelp reviews — I need to check it out sometime!

This check-cashing Florida Man is still under investigation, and no details about him — including how he fits into this whole scenario — have been released.

December 6, 2019: Tampa, Florida

FDLE investigators talk to Rappaport, who says that Halfon has made arrangements to return the checks the following week. He confirms that he never signed any of the checks.

Remember, at this point, Halfon and Rappaport have been married for just under four months and live in separate places in the same city.

December 7, 2019: Tampa, Florida

The FDLE investigators get a warrant ordering Wells Fargo to freeze the last $333,333 check.

December 10, 2019: Tampa, Florida

The FDLE investigators meet with the Amscot manager, who tells them about the phone call they received prior to Halfon’s visit. He describes the caller as a “young-sounding and outgoing” man.

The investigators also meet with Rappaport, who says:

- He never called Amscot (which you’ve probably already figured out), and

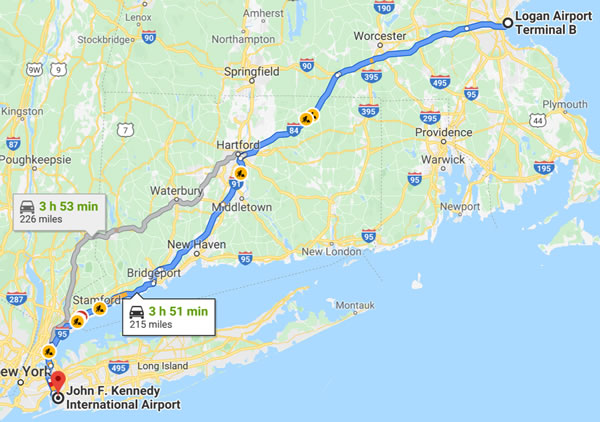

- Halfon is flying to New York on December 15 to meet a friend who is bringing the checks back from Israel (remember, two of the checks had been cashed in New Jersey two weeks prior). The friend flying in from Israel is landing in Boston.

Once again for the geographically challenged, here’s a map showing the distance between Boston’s Logan airport (where her friend is supposedly arriving), and New York’s JFK airport (where Halfon is flying):

Yes, I’m confused too.

One of the investigators asks Rappaport if he feels that he’s the victim of fraud and theft, and he says yes.

December 11, 2019: Tampa, Florida

FDLE investigators learn that in a change of plans, Halfon had flew to New York that morning. The original plan was to fly to New York on the 15th.

December 16, 2019: Tampa International Airport

Creative Commons photo by Michel Curi. Tap to see the original.

Upon returning from New York, Halfon is arrested and charged with the following:

- Fraud,

- Money laundering, and

- The oh-so-Florida crime of exploiting an elderly person.

Sometime between December 16 and December 23, 2019: Tampa, Florida

Halfon hires Tampa attorney Todd Foster, who specializes in defendants accused of white-collar crime. Foster tells the Tampa Bay Times that “There’s a valid marriage between this couple and we look forward to bringing forward additional facts to bring clarity to this situation.” I assume he said this with a straight face, which might have taken some doing.

You’re probably wondering how she’s paying for the lawyer’s services. So am I.

December 23, 2019: Tampa, Florida

The Tampa Bay Times publishes the story under the headline Attempt to cash $1 million check at a Tampa Amscot leads to woman’s arrest, authorities say.

December 26, 2019

The story goes national as NBC News publishes it under the headline 26-year-old wife accused of trying to steal $1M from 77-year-old husband.

Halfon’s lawyer talked to NBC News:

The defendant and Rappaport “love each other” and that she has no incentive to steal, Foster told NBC News.

“As far as I know it’s (a) completely legitimate” marriage, Foster said, after visiting his client in jail on Thursday. “I believe there were lawyers involved and secured prenuptial agreements.”

Foster did not confirm or contest the prosecution’s allegation that Halfon tried to cash a $1 million draft at a check-cashing store — but said his client, who is new to the country, might not be fully versed in U.S. banking practices.

He insisted Halfon did nothing illegal.

“She did not stand to have any financial advantage from the allegations in the affidavit,” Foster said.

One reply on “A timeline of the story about the 26-year old Florida woman who tried to cash a million-dollar check at a payday loan place”

This is interesting. Two of the three checks were cashed. Obviously, they weren’t turned into cash money, but the money could have been wired to a bank or elsewhere, perhaps even Israel. For a 3-5% fee, I can imagine one of the clerks in New Jersey playing along.

Who was the “Florida man” who cashed the check? What was all the flying around about? One obvious answer is that the man was Halfon. I seriously doubt she was asked to drop her pants. Odds are the deal was worked without her even needed to show ID.

What were the checks all about? The obvious answer was that Rappaport needed the money for any number of reasons, blackmail, illiquidity or just plain greed. Perhaps it was entailed in some way and he wanted freer access. Halfon offered to help him out as part of the deal.

Maybe I’m off base, but Halfon could flee to Israel and avoid extradition. There are too many green herrings here.

This reminds me of Mark Evanier’s convoluted explanation of a $1.5M gambling chip theft in Las Vegas: https://www.newsfromme.com/2010/12/19/oceans-three/