I remember hearing The Three Laws of Money from OpenCola’s cofounder John Henson when I worked there — 2000 through 2002 — during those high-flying days at the end of the dot-com bubble. He said he heard it from someone else, but I can’t remember whom.

In light of everything that’s happened with cryptocurrency this year, I thought I’d post this and remind everyone of rule three.

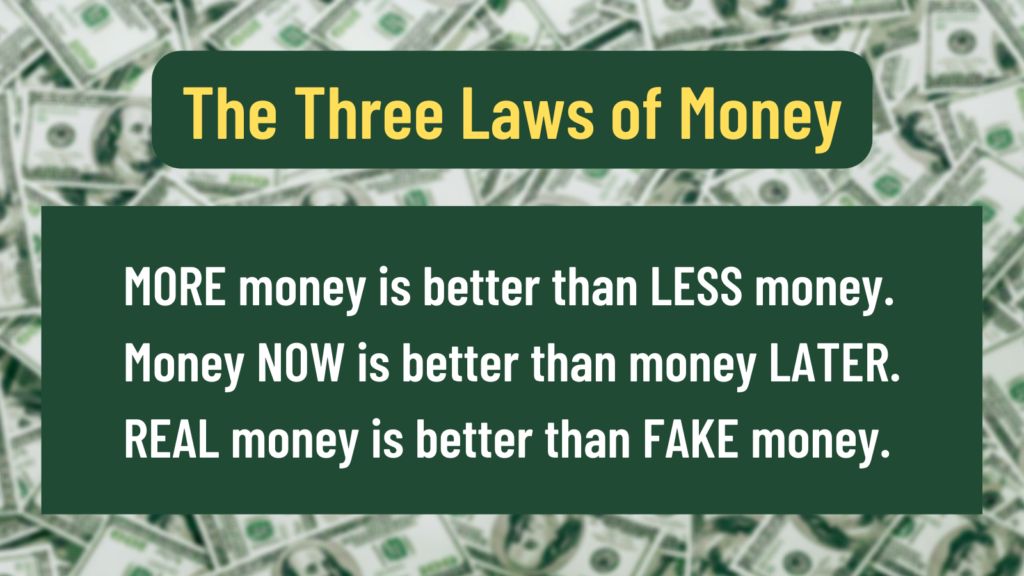

Once again, the Three Laws of Money are:

- MORE money is better than LESS money. Obvious, but sometimes we need to be reminded of the obvious. More money means you can buy more goods and services, have more influence, and invest more to increase your money supply.

- Money NOW is better than money LATER. This is a greatly simplified summary of the time value of money: a dollar (or pick your favorite currency) today is worth more than the same dollar in the future.

- REAL money is better than FAKE money. And real vs. fake isn’t an either-or thing, but two ends of a spectrum. The more people that accept a kind of money, the more “real” it is. As the de facto world reserve currency, the U.S. dollar is very real. The Iranian Rial, the cheapest currency in the world at the time of writing, is less “real”. I will leave determining the “reality” of cryptocurrencies as an exercise for the reader.