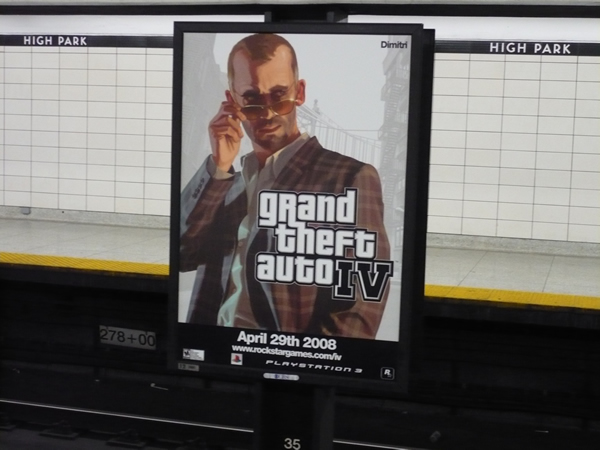

I took the photo below in High Park station this morning:

This photo is a sign of two things:

- The Toronto Transit Commission is back in action (and running smoothly from most accounts).

- Grand Theft Auto IV gets released at midnight! All branches of Future Shop (except in Quebec and Sudbury) and EB Games as well as the downtown Best Buy will open at midnight tonight to sell it, and I’m thinking of getting a copy tonight. The reviews of the game have all been glowing, and it’s expected to sell about 9 million copies at launch, putting it on par with the opening weekends of major movies. And why not? More and more, I’m of the opinion that I’d rather take a really good, immersive videogame over a movie.

![[Suitcase 1] This one’s free…[Suitcase 2] this’ll cost ya](https://www.joeydevilla.com/wordpress/wp-content/uploads/2008/04/this_ones_free_thisll_cost_ya.jpg)